Money Notes 3 – JOINED AT THE HIP by Gordon Swire

‘Many have made a trade of delusions and false miracles, deceiving the multitudes.’ Leonardo da Vinci

In 1933 after the stock market crash of 1929 and the ensuing depression a piece of legislation was passed in the USA that effectively prohibited Wall Street investment banks, those gambling on the part of large investors, from being joined to retail banks, those that look after the money of the ‘man in the street’. There was effectively a firewall put between them to curtail many of the shady practices that had characterised the age. It was called the ‘Glass Steagall Act’ and it ensured that the risks that Wall Street insiders took stayed solely on the street.

But, with the rise of our modern financial economy, one that relies on accruing increasing amounts of debt, the rules of the Glass Steagall act were increasingly circumvented, diluted and finally in 1999 consigned by President Bill Clinton to the financial history bin. London’s ‘Big Bang’ debut was an integral part of this de-regulation and was promoted under Maggie Thatcher in the 1980’s. London with ultra-loose banking regulation became a great place for banks from all over the world to run their debt fuelled operations.

Then after the Tories got booted out in 1997 the Labour Party joined in the fun. Chancellor Gordon Brown applauded the banking titans of the City of London where wealth, jobs and enormous amounts of tax money were now being generated for him to spend. His speeches were replete with words of support, for more flexibility, for innovation, and for less regulation. He once famously stated “there will be no more boom and bust” and this from someone who ran the country’s finances.

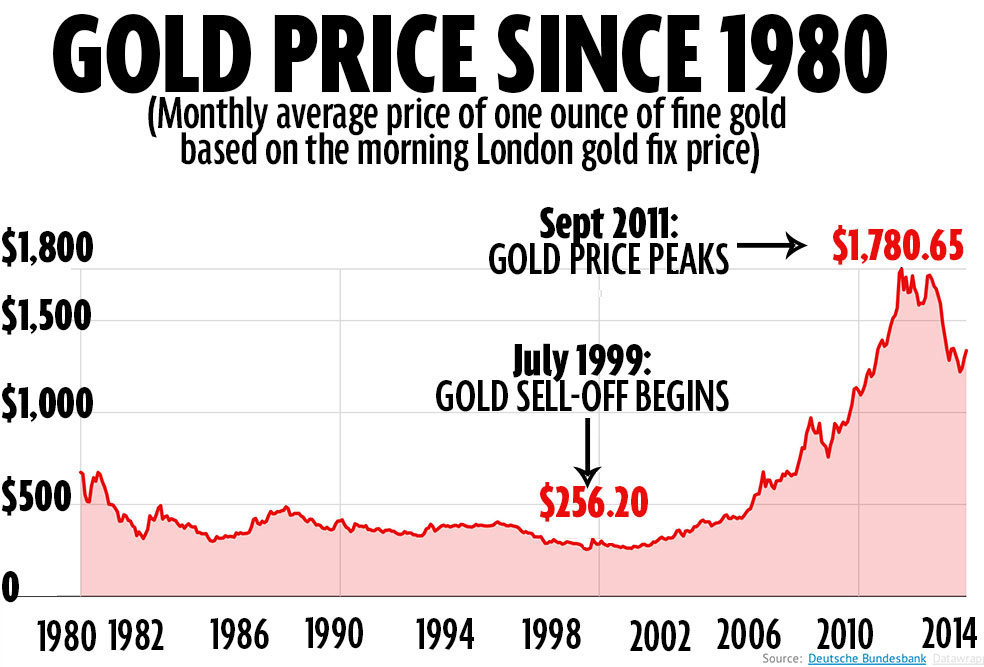

Gordon’s greatest wheeze of course was to sell 400 tons of Britain’s gold, where he employed a brilliant ‘Mr Bean’ style tactic – he let the whole world know in advance that he was planning to sell it. Not surprisingly the price he got was the lowest in 20 years and is colloquially referred to by insiders as ‘The Brown Bottom’ – no disrespect to Gordon of course but he really should stick to running baths rather than countries. It raised around four billion dollars at the time and would be worth about $25 billion today – so only a loss of a cool $20 billion.

Financial racketeering grew across both sides of the Atlantic with new house rules, new debt instruments called derivatives that defied logic and a whole new language. The deals that new computer algorithms were churning out carried exotic names like ‘Credit Default Swaps’ and ‘Collateralised Debt Obligations’ and one mortgage fund even sported the glittering title ‘The Bear Stearns High Grade Structured Credit Strategies Enhanced Leverage Fund’.

Many bank managers who should have known better now couldn’t understand what their banks were buying or selling. The debts grew, the daylight robbery grew and most important for the inside players the salaries, bonuses and payoffs grew. Between 2003 and 2008 the heads of Wall Street banks were pulling in average salaries of $30 million a year.

Britain was the first in the club to experience a run on a major bank, Northern Rock, in September 2007. Long lines of people eager to withdraw their money wound their way down the street and across the world’s TV stations. The game was up, mutual trust between financiers began to disappear, the emperor stood naked, the day of reckoning had arrived, the Great Financial Crash had hit town.

The Queen who’s bank balance had shrunk by a mere £25 million while on a tour of the London School of Economics posed the question “why if it was so massive did no one see the financial crisis coming”. I can’t remember what reason she was given but she would certainly have been lied to. Lots of insiders knew it was coming, that the banking, insurance and mortgage industries were taking on huge risks that could not be sustained, but all were too busy raking in massive profits to bother with unintended consequences.

The reason they didn’t bother is because they knew they had a ‘get out of jail free’ card. Why, because the investment banks that were busy speculating and leveraging up their bets, debt promises to you and me, knew that their politicians would be forced to support them if things went awry.

Trading strategies were so complex and intertwined that one bank going under would spark a daisy chain of defaults across the whole world financial community and in this new de-regulated age the retail banks would be dragged under with them.

Across the globe, debt obligations of large investment banks were now pooled with those of retail banks like Britain’s Northern Rock, they were effectively joined at the hip.

The man in the street would lose his money, his job, his way of life. Governments contemplated disaster. Politicians would lose their jobs. Chaos, rebellion, anarchy!

Gargantuan amounts of money had to be thrown at the banks to keep them alive, hundreds of billions of pounds, dollars and euros. AIG the world’s largest insurance company with 116 thousand employees around the world needed recuing, and the usual culprits like Goldman Sachs, Morgan Stanley and European companies like Deutsche Bank and Barclays were all in line for the payoff.

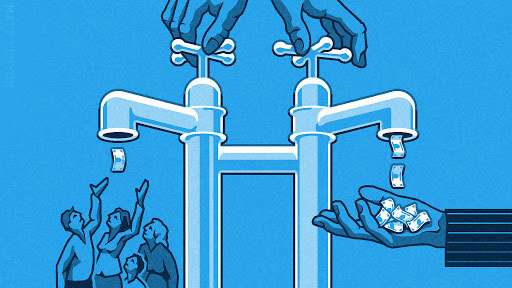

Insiders at these large financial groups had made their money, taken their salaries, paid their shareholders, sold their share options, and bought their yachts. And being joined at the hip meant the enormous rescue funds needed to re-finance these companies were to be provided by society, by the tax payer, people like you and me.

Profits had been privatised, debts had been socialised.

Some of the characters are interesting to note.

In Britain the notorious culprit to hit the headlines was Sir Fred Goodwin knighted for his services to banking. He was known as ‘Fred the Shred’ for his cost-cutting skills, which I think translates as being adept at the firing of staff. He earned £4 million a year as he valiantly led the Royal Bank of Scotland towards oblivion with a loss of £24 Billion. On leaving he pocketed a £17 million pension plan and the public were so outraged the Queen was forced to annul his title.

In America one of the most colourful characters was Jimmy Cayne who actually started life as a scrap metal dealer before entering the world of finance where he headed up Bear Sterns and where he amassed a personal fortune of over $1 Billion in the company’s shares. In 2007 this was a bank that traded derivatives contracts of over $13 Trillion and that employed 14,000 people. In September 2008 it became the first US bank to need life support.

Another contender would be Dick Fuld, head of Lehman Brothers and nicknamed “Gorilla” because of his broad sloping forehead, his tendency to grunt a lot, and a life-size gorilla he kept beside his desk. His bank was the first to be targeted and denied a bailout. It went bankrupt in September 2008, the largest such court action in US history, valued at £639 billion. This was the catalyst that really stunned the world’s financiers and led to a worldwide contagion.

These characters strike me as being from the same school of business as Del Boy of ‘Only Fools and Horses’ fame. People who live by bending rules, by deception, and scam, their only opponents a clueless committee like the Financial Services Authority in Britain or in the US the Federal Reserve Board, where over one thousand PHD economists, the largest single grouping in the world, could not collectively see the writing on the wall as their financial world was plundered.

It gave way to the greatest transfer of wealth in history and is a process that is still large and at play today. No one in the US or Britain was put in prison for fraud or embezzlement, no one had their wealth taken away, and new banking laws like the Glass Steagall Act of the 1930’s have not been reimposed to protect us.

A looting of colossal wealth that future generations are going to pay for in taxes, inflated prices and poorer living standards. The ballooning debt that caused the problem in the first place has not been checked either, in fact quite the opposite, it’s just simply grown a lot larger.

Lots of the major players are still in the same roles and the curtains have been drawn apart again, there are new lines of dialogue, new stories to tell, the piece is on again. And the experience has left an extremely bitter taste in everyone’s mouth and the lingering thought in many people’s minds, ‘What’s to stop it all happening again’

——————————————

MONEY NOTES 1 – MASTERS OF THE UNIVERSE

MONEY NOTES 2 – THE GREAT RESET

Great article! Thanks Gordon!

Comment by Jeffrey Jordan on 04/11/2020 at 8:24 pm