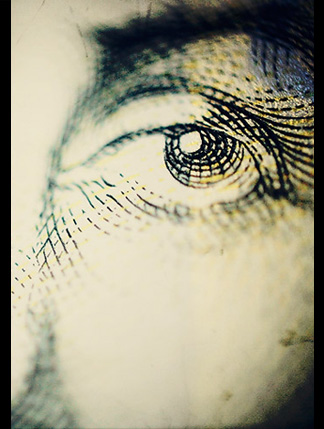

One man’s advantage is another’s suffering

The financial crisis is an exact match of the ecological crisis. More than 90% of the world’s natural resources are owned by private interests, business and government – and they are exploited to the hilt. There is nothing left to exploit! That is why we have a financial crisis.

The financial crisis is an exact match of the ecological crisis. More than 90% of the world’s natural resources are owned by private interests, business and government – and they are exploited to the hilt. There is nothing left to exploit! That is why we have a financial crisis.

The pundits keep these complementary facts apart and as if money spent on climate change would make us suffer, whereas the only people who would suffer are shareholders. When they talk about growth they are lying. It is very clear today that one man’s advantage is another’s suffering.

Capitalism is the astounding belief that the most wickedest of men will do the most wickedest of things for the greatest good of everyone. John Maynard Keynes

At the end of the 2nd World War, the Allies got together to consider implementing the economic system which John Maynard Keynes had worked out. Everyone was excited because they thought his system would be an end to war. Keynes’ idea was to have a world bank which would balance the world economy and create the same opportunities for all. The nations with a surplus would be obliged to balance their accounts within a year – or have the surplus confiscated. The surplus (and help) would be given to countries who had a trade deficit.

America rejected this plan. All the other countries were in debt to her, so they had to obey. America stated: The world is finite with diminishing resources. The American standard of living is sacred and the level of wealth must be maintained. Therefore, from now on, America must have a greater share of the cake. (These are not the exact words but this is what America said at the time – I have always remembered it. I was shocked that they dared to be so blatant.)

The consequences of this decision for the poorest countries have been ruinous to their development. Today, we can see the global impact this has had financially – matched by the catastrophic environmental consequences for us all.

To read more about this, go to:

http://www.monbiot.com/archives/2008/11/18/clearing-up-this-mess/ The details are fascinating!

In my next blog, we return to the Manifesto and the Art Lover, who tells Pinocchio, Art cannot imitate life directly – it does it by representation as in a microcosm.

Dear Vivienne

We hear such anger today about the extravagant bonuses being paid to bankers – it’s even being called ‘banker bashing’. But people are angry and can no longer accept the inequality that has been based on the assumption that free-markets make us all richer in the end. After 30 years of deregulation and tax cuts for the rich, growth has slowed down rather than accelerated in almost all countries. In the UK, this is thanks largely to Margaret Thatcher’s policies in the 80s. At the heart of this slowdown lies the free-market policy package. In developing countries, liberalisation of trade has helped destroy ‘infant’ industries. In both developing and developed countries, policies to reduce inflation to very low levels have choked demand and made business loans expensive.

Financial deregulation has given real power to mobile shareholders looking for short-term profits and high dividends. The surest way to deliver these is to minimise long-term investments, like machinery and research and development. Share holders encourage this behaviour by paying astronomical salaries to managers good at making these cuts, even though they weaken the growth prospects of companies in the long-run. Shareholders don’t necessarily care about the long-term future of their companies – or the world we all live in: they can always sell their shares and move on. Where is the responsibility? The prevailing mentality is, instead, never mind if we lose the rainforests – we’ll make our money selling beach holidays in the arctic!

The current financial crisis is in large part caused by the imbalance of trade between nations – countries with trade deficits become debtors. This debt wrecks people’s lives, ruins the environment and destabilises the global economic system. Every day, we hear about the crisis but not the causes. We should have listened to Keynes.

Comment by Helen Kelman on 13/02/2011 at 8:03 pm

Hello again Vivienne,

While my comment here is not in direct response to this recent post, I believe it is something you may be interested in…

I would like to ask you to support a campaign I’m working on. Its about reducing plastic bag usage. The idea is to collect a week’s worth of London’s plastic bags in one place, so that people can witness the cumulative effect of our individual actions.

As you can probably imagine this is a large number of plastic bags, something in the region of 37,000,000 in fact.

Once collected, in a prominent place, Trafalgar Square for example, they will act as a beacon to remind people to take their own bags with them when they go to the supermarket.

At the moment I am contacting the Greater London Authority and various supermarkets to see if I can get their support.

Would you be interested in lending your voice to this campaign?

Simon

Comment by Simon McAndrew on 16/02/2011 at 4:45 pm

Our business is infested with idiots who try to impress by utilizing pretentious jargon.

The majority of what we call management consists of which makes it difficult for people to manage to get thier work done.

Comment by Michael Benz on 12/03/2012 at 9:46 am