Land Tax

Quotes are from intellectual Fred Harrison, director of the Land Research Trust. (As Evil Does)

Our Rotten Financial System is the cause of all our problems from poverty to Climate Change – taking us to destruction. It wasn’t always like this. If we could go back to the simple land tax we would automatically solve everything – save the world from destruction.

The Rotten Financial System is false economy; completely rigged, programmed to cause poverty and suck up profit for the rich; not true accounting, hocus-pocus maintained by propaganda.

Economy that honoured the social value of land is the only real economy, and Intellectuals Unite will fight for it; indeed it should be what binds us.

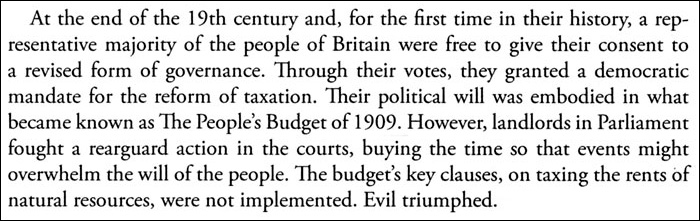

Our whole history would be different. We need to go back to Magna Carta 1215. The barons rented the land in the form of services, cash and kind. They inserted a property tax into Magna Carta. (They wanted to get at middle-class man – these burghers with their trades and houses) Within ten years most of the government’s expenditure came from property tax and eventually spread to everyone, right down to the poorest, irrespective of if they held land.

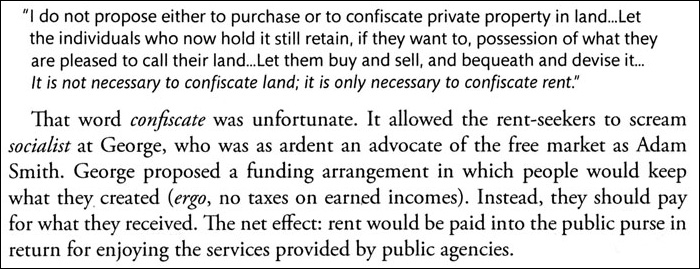

The Free Trade industrialists of the 19th century wanted a land tax. The most radical campaigner for tax reform was Henry George from San Francisco whose book Progress and Poverty (1879) became the first best-selling text on economics in history, and it inspired the first global reform movement.

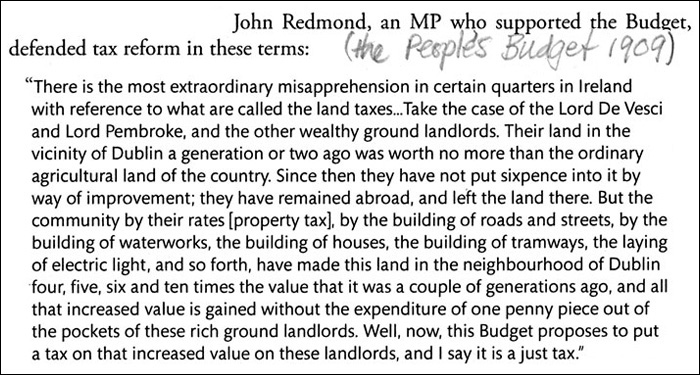

As a Liberal MP, Winston Churchill along with David Lloyd George campaigned to reform High Finance by taxing the rents of landowners.

Rent is a term in economics related to land. It is the difference in value between land which is not worth cultivating (you can’t make a profit) and fertile land. There would be no tax on profits and wages or property, people would keep what they earned. (Churchill called the ownership of land “the mother of all monopolies”).

This means that land rent would be set at a price where people would decide whether to rent or not. Therefore it would be easy for public servants to decide the rent by referring to market value set against public interest.

Rent has also come to mean the value of land with improvements including private and public buildings. This is commercial rent. For tax purposes land should be valued by excluding the man made improvements. All that is required is the payment of the annual ground rent into the public purse.

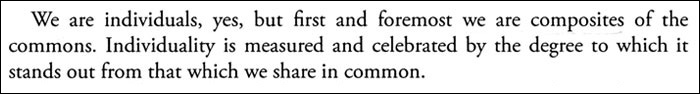

Wealth is a composite of the services of the earth and society.

We and all life forms have evolved with the earth (Gaia theory of evolution) – To make a boat you need a tree, which grows on land; in addition to the tree, we also need the knowledge that, by hollowing it out, we have a boat that can float! “People have a right of access to their natural environment” – to land.

Re-introduction of land tax places our economy on its natural foundation. Its true value is its value to everyone, not to the advantage of individuals or cartels. In a word it gives us back the commons.

Fred understands how our full relationship with the commons is necessary to our evolution as a species, and to civilization.

First he talks about rent: “Rent is the material basis of the common good”…”the material embodiment of our humanity”. He means rent is the value added to land by our labour and skills and ideas; land is common space where we build culture and value and community.

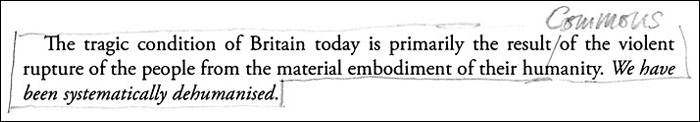

Of the commons he says:

Far from a life of human relationships and culture, our whole lives are dictated by the housing ladder – every man for himself.

Without the commons we have no roots, no rock; we cannot engage with the world. It is hard to fight the bullies and spinners after they have stolen our space.

Land tax and right to the commons bring freedom and the means to help each other: Liberty, Equality, Fraternity. We all thought that was impossible. May we live in peace with Gaia.

http://www.facebook.com/AGRforScotland

Comment by Our country is crying out for rent as revenue instead of the landlord designed taxes we have inherited from the stone age. In Scotland we call it AGR (Annual Ground Rent). See www.facebook.com/AGRforScotland on 22/04/2016 at 10:55 am

Yes indeed! In Australia, we used to build roads, highways, bridges, dams and railways by getting the public to pay back a small part of the uplift in their land values that this infrastructure provided them. We founded Canberra on a land rent system and instituted a federal land tax in 1910. Land and nature mattered. No longer. All the annual value of land must now go to rent-seeking companies and individuals. So, instead of capturing land values for revenue, we tax wages and profits into submission, and Australia lurches to a standstill much like the UK, Europe and the US. May you have good luck in waking people up to life and nature’s economic realities!

Comment by Bryan Kavanagh on 22/04/2016 at 11:49 am

Thank you, VW, for seeing where our best interests are. The sheer human waste of taxing labour and capital so land rents can be capitalized is an outrage. Reforming this offers an economic Golden Age – which even the landowners would benefit from.

Comment by David Collyer on 22/04/2016 at 12:21 pm

Absolutely right. Return the (annual rental) value of the land to us the people who collectively create this value but allow it to be appropriated by a minority who own title deeds and can live off these unearned incomes while we all pay taxes on what we earn. Those taxes in turn finance the infrastructure that continually enhances privately appropriated rent and land values, notably in our cities. Ground rents should be our common birthright. QED.

Comment by Roger Sandilands on 22/04/2016 at 1:10 pm

Welcome, Vivienne, to the small but growing group of thoughtful people (including some intellectuals) who have come to embrace the principle that the earth is the equal birthright of all persons. This principle is at the center of my belief system of cooperative individualism. Hopefully, these principles will find broad acceptance before it is too late.

Comment by Edward J. Dodson on 22/04/2016 at 8:40 pm